FUNDRAISING

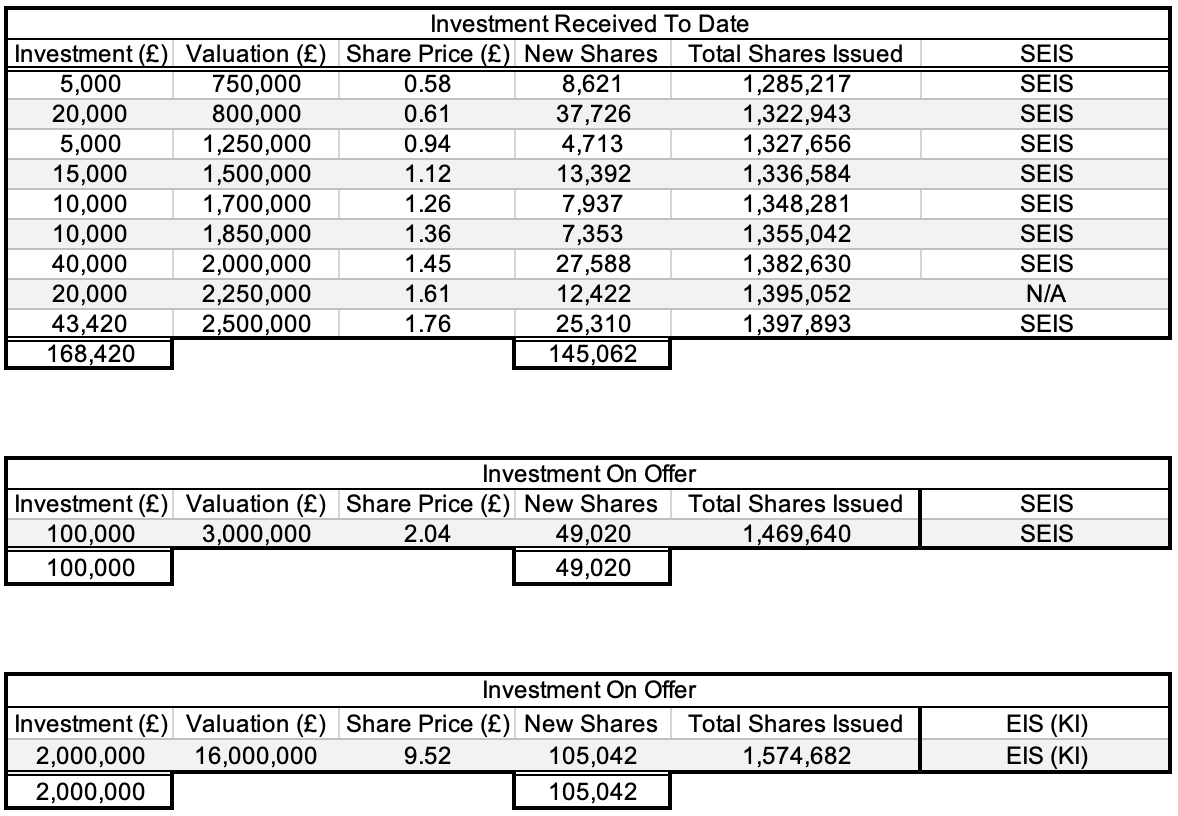

Unique Platforms Limited owns 100% both Trading Games and its sister company Random Walk Casino. Unique Platforms is in the process of fundraising to finance the development of these two companies.

N.B. All money raised will be used over the next three years on Trading Games and Random Walk Casino only.

There are two ways to raise money:

- one figures out how much investment is required over a, say, three year period and then hope to be able to raise that money. It is a hit-or-miss affair.

- an alternative is to ‘bootstrap’. This involves setting out a micro path where every incremental investment achieves a certain target. On achieving that target the company is now worth more and the company can now raise a further incremental amount at a higher capitalisation.

Bootstrapping example: Unique Platforms raises £50,000 and is able to get the first game in a position to take it ‘live’. Once ‘live’ the company now has a minimum viable product (MVP) which means the business is now worth more. It raises a further £25,000 which enables the company to attain a gambling license. This is now of value to a certain investor who is now prepared to invest. The company has grown yet again.

This manner of raising capital has many attributes to both investor and start-up:

- Assuming the equity has pre-emption rights, a previous investor always has first refusal of stock at a higher level. This means that the investor’s risk is dissipated as they can stop out their investment. Having to buy a larger chunk at a higher price creates greater risk for the investor.

- For the company there is the benefit of always being able to progress. The company can gain momentum (which is sometimes referred to as ‘traction’) which is an important fillip to a keyed up team of entrepreneurs who are keen to get to market.

SEED ENTERPRISE INVESTMENT SCHEME (SEIS)

Unique Platforms is currently looking to raise £100,000 at a post-new money valuation of £3m..

Unique Platforms has SEIS Advanced Assurance awarded from HMRC so this £100,000 allows the UK investor to deduct 50% of their investment from their 2022/23 income tax liability assuming they have not used up all their £100,000 allowance. If they have used up all the £100,000 2022/23 allowance then then the tax relief is obtained this year. Or if already paid, a reimbursement will be forthcoming.

Please consult your financial advisor/accountant/tax expert on the workings of the Seed Enterprise Investment Scheme. Do not take this site’s word for it.

ENTERPRISE INVESTMENT SCHEME (EIS) (KNOWLEDGE INTENSIVE)

Unique Platforms has also been granted by the HMRC Enterprise Investment Scheme (KI) Advanced Assurance to raise up to £2m.. This means that the investor can reclaim 30% of their investment in the form of income tax relief.

The ‘KI’ stands for ‘Knowledge Intensive’ which is a status over and above plain Advanced Assurance. One advantage of the KI is that it enables the investor to reclaim their tax relief earlier than would otherwise be possible.

N.B. THE INVESTOR MUST TAKE PROFESSIONAL ADVICE WHEN DETERMINING WHETHER TO INVEST OR NOT.

For potential investors: please contact Hamish Raw at hamish@uniqueplatforms.com